Every year, Kenyans are required to file their employment income tax returns with the Kenya Revenue Authority (KRA) to comply with the law. The deadline for this is the 30th of June. This article will explain the process by answering the question of how to file KRA tax returns.

The advancement in technology has made the process easier by eliminating the need to physically visit KRA offices by enabling online self-filing on the KRA online portal. This makes the process more convenient and faster.

The law requires all Kenyans to file their tax returns whether they are making income or not. Those without any income normally file zero returns.

Below are the steps you need to follow when filing your returns.

1. Get the P9 form

To file your employment income tax, you require a p9 form from your employer. This is a form that includes all the information about your income and tax deductions for the year. Some of the details in the P9 form includes

- Total gross pay for the year

- Tax personal relief

- Pension payment

- PAYE

- Taxable pay

This is the information that you use to file returns on Itax.

With your P9 form ready, the next step is to visit the KRA itax Portal. This is the portal that handles all matters on tax returns.

2. Log in to your Itax account

To log in, you are required to input your pin and password on Itax. The above image shows what the login page looks like. If it is your first time using the portal, then you should register first to enable login. It also allows password change.

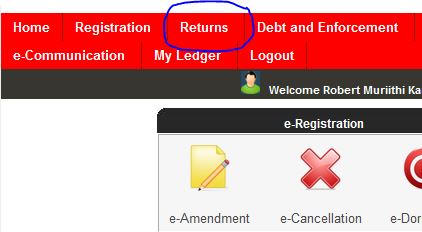

3. Go to the returns menu

After a successful login, you should visit the return menu above. The returns menu enables you to choose the type of returns that you are filing.

Once there, chose self as the type of the returns. On the obligation box, chose income tax for the resident.

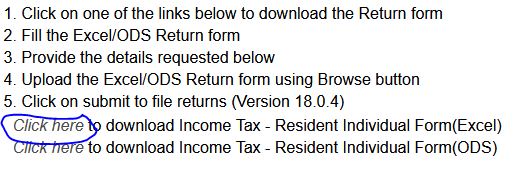

4. Download the income tax excel form for the resident individual

After choosing the type of tax returns you want to file, you should proceed to download the returns excel form using the above process.

The excel form is customized and compressed. Ensure to click the highlighted button above.

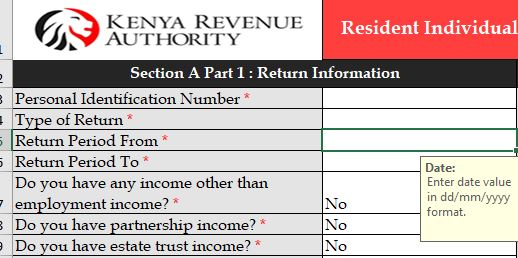

5. Filling the return details on the returns excel

With the returns excel form, ensure to fill in the details as per the form request. These are the details found in the p9 form. Ensure not to change anything on the excel filing form as it will decline validation.

It also restricts some functions such as copying and pasting information. Hence, you should type all the input information.

Below is a sample of the first sheet on the excel form. Some of the details necessary include the duration of the filing and both your KRA pin and Employers pin.

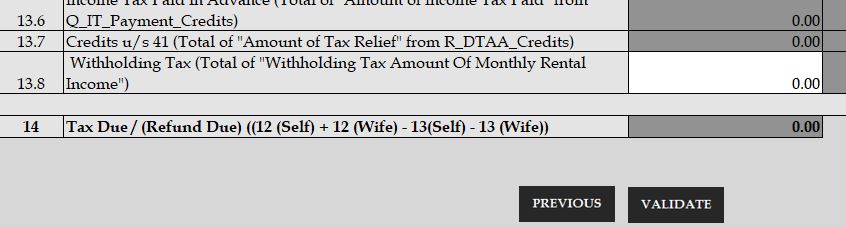

6. Confirmation and validation

The last step on the excel form is to confirm and validate your details as shown below. The objective of this process is to confirm where you have full compliance with your tax obligation.

This is shown through the final value in the tax due and refund due row. The common objective is to get a zero in this figure. It is an indicator of full tax compliance for the year. However, you can also get either a positive or negative value indicating you have either underpaid or overpaid your tax for the year.

In case of any errors or missing details, the validation process will fail. Hence, you are required to do corrections where need be.

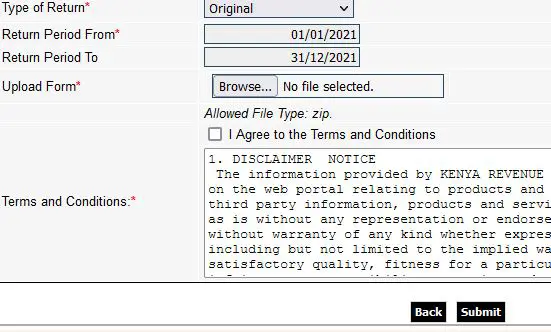

7. Submission of the returns

This is the last step after validating your returns.

You are supposed to upload the validated excel then submit it as per the above illustration. Upon submission, the Kenya revenue authority sends you a confirmation receipt of the filing on the registered email. You should download and store it for your reference.

Conclusion on How to File KRA Tax Returns

From the above information, the tax returns filing process is not as complicated as most people assume. It takes less than 30 minutes to complete the process

However, in case you face any challenges in this process, you can always engage the services of tax professionals or visit KRA offices across the country.

![]()

[…] How to File KRA Tax Returns: Step by Step […]

[…] How to File KRA Tax Returns: Step by Step […]

[…] How to File KRA Tax Returns: Step by Step […]

[…] How to File KRA Tax Returns: Step by Step […]

[…] Various obligations come with having a KRA pin certificate. These include filing annual tax returns. You should do this by the 30th of June. Learn more about How to file your KRA returns. […]

[…] How to File KRA Tax Returns […]